Vulnerable social groups have been particularly affected by the pandemic and poverty is set to increase as jobs are lost and self-employed see incomes dwindle, accentuating regional differences. The COVID-19 crisis has emphasized the need to re-train and up-skill the population, secure access to affordable housing by reducing bottlenecks to supply and to revive investment.

Economic Policy Reforms 2021

United Kingdom

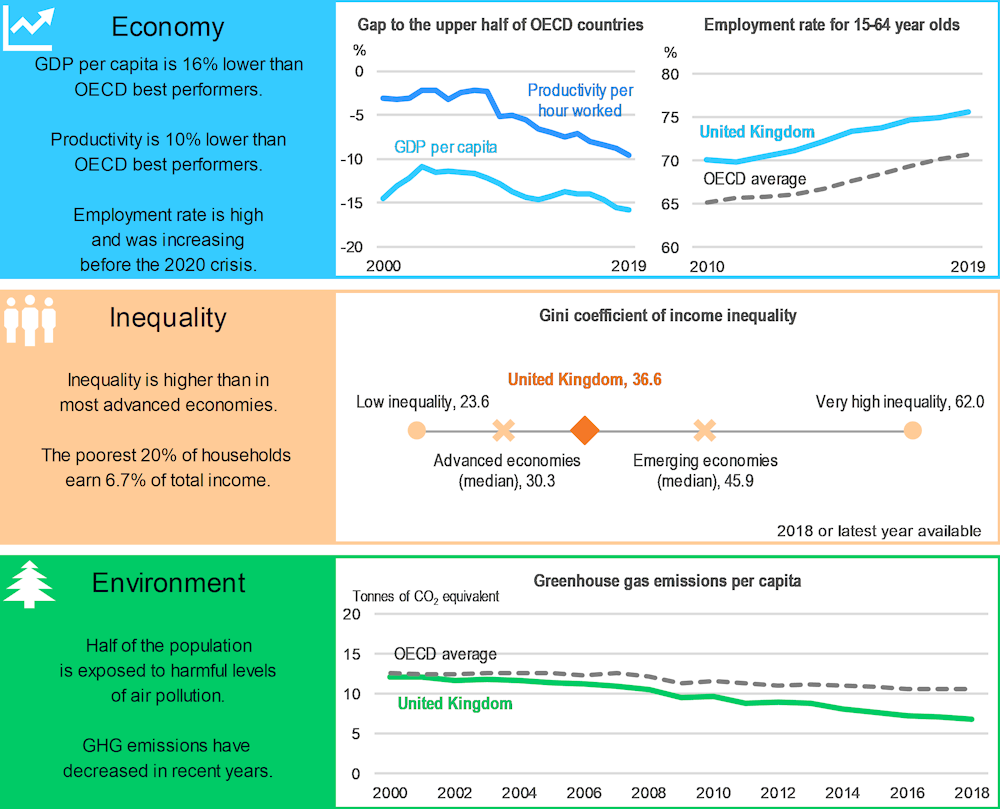

United Kingdom: Performance prior to the COVID-19 crisis

Economy: Percentage gap with respect to the population-weighted average of the highest 18 OECD countries in terms of GDP per capita (in constant 2015 PPPs).

Inequality: The Gini coefficient for disposable income measures the extent to which the distribution of disposable income among households deviates from perfect equal distribution. A value of zero represents perfect equality and a value of 100 extreme inequality.

Environment: Greenhouse gas (GHG) emissions include emissions or removals from land-use, land-use change and forestry (LULUCF). A high exposure to air pollution refers to above 10 μg/m3 of PM2.5.

Source: Economy: OECD, National Accounts, Productivity and Labour Force Statistics Databases; Inequality: OECD, Income Distribution Database and World Bank, World Development Indicators Database; Environment: OECD, Environment Database and United Nations Framework Convention on Climate Change (UNFCCC) Database.

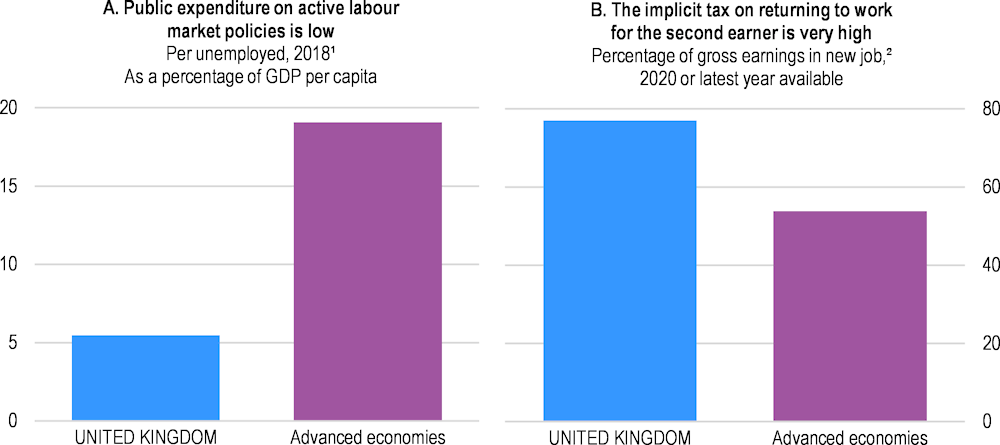

Life-long learning and investment to ensure broad growth benefits

Given the pre-pandemic large skills gaps of the population and inequality concerns, funding for lifelong learning should be increased further. The United Kingdom has one of the highest shares of under-qualified workers among OECD countries while public and corporate spending on adult learning has declined, alongside participation in lifelong training. Support for job search, skills and apprenticeships, set out in July 2020, should be increased further, giving priority access to low-wage-low-skilled workers and good quality ICT trainings. Enhancing the overall access to Jobcentre Plus, the public employment service, and raising the quality and effectiveness of training programmes, would ease the impact of structural changes triggered by COVID and digitalisation (Panel A).

After decades of public under-investment, there is a considerable need to invest in infrastructure, including digital. Large investment is also needed to move toward a low-carbon economy and to tackle the long-standing challenge of narrowing regional differences, likely exacerbated by the COVID-19 crisis. The pandemic slowed private investment further, which has been weak since the 2016 referendum to leave the European Union (EU). Investment can be revived by maintaining low barriers to trade and investment with the EU and other trading partners. Easing land use regulations while balancing resource allocation, environmental and social concerns can also spur more investment in housing, improving housing affordability and competition in construction. The Government’s 2020 White paper on the issue is welcome and policy measures should follow. These should be complemented by making the temporary cut in the stamp duty permanent and reforming the regressive Council tax.

United Kingdom: Vulnerabilities and areas for reform

1. For the United Kingdom, the latest year available is 2011.

2. Second earner taking up employment at 67% of average wage with the first earner at the average wage.

Source: Panel A: OECD, Public expenditure and participant stocks on LMP and Economic Outlook Databases; Panel B: OECD, Tax-Benefit Models.

High childcare costs continue to pose a hurdle to working mothers, who also took more responsibility for childcare during the lockdown (Panel B). Increasing support for full-time good-quality childcare would allow them to return to work. To leverage private sector innovation in emerging sectors and potentially “disruptive” technologies, ensure a balance between direct R&D support and tax incentives. Furthermore, channel the support also to smaller companies.

United Kingdom: Summary of Going for Growth priorities and recommendations

|

2019-2020 Reforms |

Recommendations |

|---|---|

|

Education and skills: Boost funding for lifelong learning |

|

|

☑ From August 2020, the Government has been extending the statutory entitlements of the Adult Education Budget to fully fund all adults to take basic digital skills courses. ☑ The Youth Obligation Support Programme helps young people develop the skills and experience they need to get into sustainable employment. ☑ Funding to skills and apprenticeships was increased by GBP 1.6 billion in the 2020 Plan for Jobs. |

□ Continue to boost funding for lifelong learning, prioritising improved access for low wage, low-skilled workers. □ Improve access to, quality and effectiveness of training programmes offered by Jobcentre Plus, the public employment service. □ Provide good quality ICT training to low-skilled workers. |

|

Infrastructure: Increase public investment, prioritising digital infrastructure and deprived regions |

|

|

☑ The Government allocated GBP 88 billion for roads, railways, communications, schools, hospitals and power networks across the country in the 2020 Budget and accelerated some public investment plans in response to the COVID-19 crisis. |

□ A planned sustained increase in public investment, prioritising digital infrastructure and deprived regions, could bring sizeable long-term output gains, and would help to reduce inequalities. □ Sound governance will be key to reap the full gains from increased public investments. □ Keeping low barriers to trade and investment with the European Union and others, particularly securing market access for service sectors, would be beneficial for private investments going forward. |

|

Housing: Improve housing supply and competition in construction |

|

|

No actions taken |

□ Ease land use regulations to improve housing supply and competition in construction, balancing resource allocation, environmental and social concerns. □ Move to a flat-rate Council tax, while permanently reducing the stamp duty. |

|

Labour market: Increase support for full-time good-quality childcare |

|

|

No actions taken |

□ Increase support for full-time good-quality childcare, notably by limiting costs relative to disposable income to facilitate full-time work and schooling for second earners. |

|

R&D and digitalisation: Ensure a balance between direct R&D support and tax incentives |

|

|

☑ Public spending on R&D subsidies has increased fast since the mid-2000s and is high in OECD comparison. |

□ Ensure a balance between direct R&D support and tax incentives to leverage private sector innovation in emerging sectors and potentially “disruptive” technologies. □ Put an emphasis on channeling support to smaller companies, for example with support facilities targeted directly at SMEs. |

Recent progress on structural reforms

The United Kingdom left the European Union 31 January 2020 and left the single market 31 December 2020, preparations for the exit have held up political and administrative capacity and reforms since the 2016 referendum. Lately, initiatives linked to the COVID-19 response and the Government’s plans to level up regions outside of the prosperous South-East England started addressing some long-term challenges, notably by boosting funding to public investment and skills and by outlining an overhaul of land-use regulations. However promising, these efforts need sustained attention and financing to address the underlying challenges.