The pandemic recovery offers an opportunity to reinvigorate business dynamism and ensure that education delivers on skills. This will help maintain good living standards and support comprehensive public services.

Economic Policy Reforms 2021

Norway

Norway: Performance prior to the COVID-19 crisis

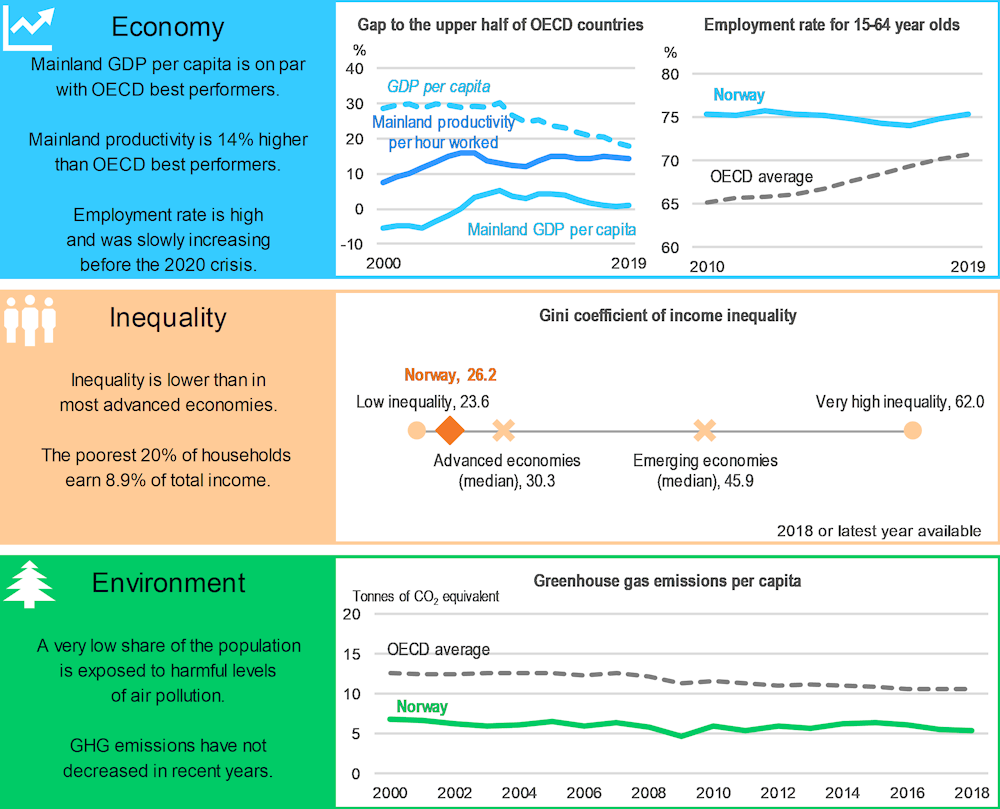

Economy: Percentage gap with respect to the population-weighted average of the highest 18 OECD countries in terms of GDP per capita (in constant 2015 PPPs). Mainland GDP per capita excludes petroleum production and shipping. While total GDP overestimates the sustainable income potential, mainland GDP slightly underestimates it since returns on the financial assets the petroleum fund holds abroad are not included.

Inequality: The Gini coefficient for disposable income measures the extent to which the distribution of disposable income among households deviates from perfect equal distribution. A value of zero represents perfect equality and a value of 100 extreme inequality.

Environment: Greenhouse gas (GHG) emissions include emissions or removals from land-use, land-use change and forestry (LULUCF). A high exposure to air pollution refers to above 10 μg/m3 of PM2.5.

Source: Economy: OECD, National Accounts, Productivity and Labour Force Statistics Databases; Inequality: OECD, Income Distribution Database and World Bank, World Development Indicators Database; Environment: OECD, Environment Database and United Nations Framework Convention on Climate Change (UNFCCC) Database.

Reviving business dynamism and education to sustain high living standards

The pandemic, as well as digital and green transitions, are likely to make some businesses non-viable. To ensure a smooth reallocation of resources, insolvency arrangements can be improved. These currently tend to over-penalise failing businesses. Time to discharge (i.e. the number of years a bankrupt person must wait until they are discharged from pre-bankruptcy indebtedness) should be shortened. Tools for insolvency prevention should be enhanced and restructuring and penalties for failed entrepreneurs could be lighter.

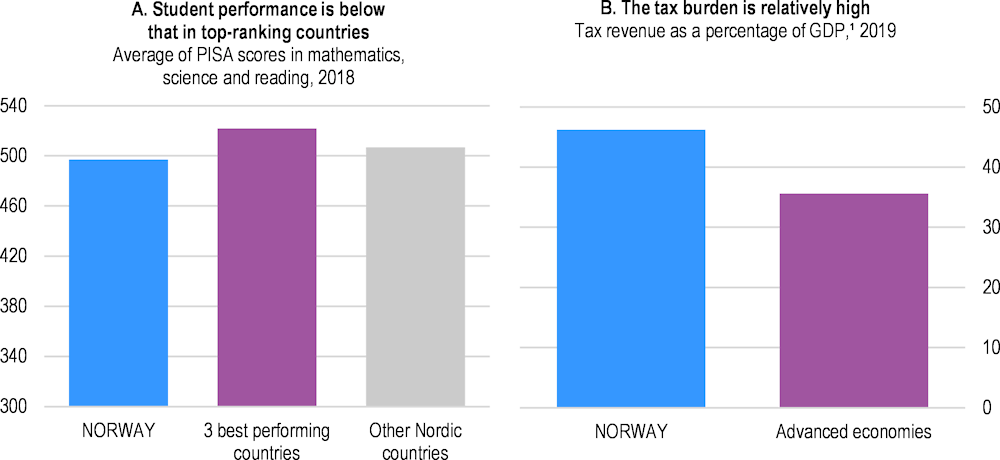

Improvements to education and training can help build capacity for a digital, as well as green, transition, enhancing productivity growth. Norway’s education system provides substantial support and encouragement for learning but this is not matched by outcomes (Panel A). As the structure of the economy shifts, additional support for training would help individuals transition into new occupations. Strengthening incentives for timely completion in higher education can make the education more efficient and effective.

As the pandemic situation stabilises, policy needs to return to the longstanding problem of elevated rates of sickness-related absence among workers and large numbers on disability benefits. This can be resolved, for instance, by lowering sick-leave compensation and by extending employers’ participation in funding it. Furthermore, reform of special retirement schemes for those working in areas such as police and defence is overdue, pension arrangements for those on disability benefits need adjusting and there is scope for more life-expectancy adjustment in the mainstream pension system.

Norway: Vulnerabilities and areas for reform

1. For Norway, data refer to non-oil tax revenue as a percentage of mainland GDP.

Source: Panel A: OECD, PISA Database; Panel B: OECD, Revenue Statistics Database.

A broad recovery strategy to attain more sustainable and resilient growth, while retaining good outcomes in equity, would be helped by ensuring taxation remains efficient by keeping the tax burden as low as possible (Panel B), while remaining firmly within the “Nordic” model of comprehensive public services and transfers. In addition, ensuring infrastructure projects are well selected and implemented is important. Norway has invested heavily, particularly in transport infrastructure, and more so in recent years. However, too many infrastructure projects fall short of best practice in terms of project selection and cost-effective implementation.

Norway: Summary of Going for Growth priorities and recommendations

|

2019-2020 Reforms |

Recommendations |

|---|---|

|

*Competition and regulation: Improve the system of business insolvency* |

|

|

*New priority * |

□ Strengthen business dynamics through better routes to recovery for businesses in difficulty, including lighter penalties for failed entrepreneurs, better prevention and streaming mechanisms, and more restructuring tools. |

|

Education: Strengthen education |

|

|

No actions taken. |

□ Press ahead with primary- and secondary-school curriculum reforms. □ Ensure that higher education institutions provide comprehensive study guidance and support services. □ Reduce apprentice remuneration to make it more attractive for employers to offer additional places. □ Link part of the employer subsidy to course completion by apprentices. □ Strengthen higher-education students’ incentives for timely course completion. |

|

Labour market: Reduce policy-induced early retirement |

|

|

☑ A public-sector pension reform, underway since 2018, is reducing incentives for early-retirement including through phase-in of flexibility in the age of retirement and in corresponding actuarial adjustment of pension pay-outs. |

□ Strengthen incentives to contain sick-leave absences, including through lowering sick-leave compensation and by extending employers’ participation in funding. □ Intensify management efforts to address sick leave in sectors facing elevated levels of absence due to illness, in particular in the public sector. □ In disability benefits, strengthen treatment and rehabilitation requirements and apply eligibility rules in general more strictly. □ Make early interventions that encourage and facilitate return to work a strong theme of future reforms to sickness leave compensation and disability benefits. □ Tighten medical assessment for both sick leave and disability benefit systems. |

|

Tax system: Make taxation more efficient |

|

|

☑ The rate of corporate tax was reduced in 2019 to 22%, the latest of several cuts in recent years reducing the rate from 28% in 2013. |

□ Aim to minimise the overall tax burden while remaining in line with the fiscal rule and the revenue demands of comprehensive public services. □ Ensure business taxation is fair and consistent by working further on countering base erosion and profit shifting. □ Work on inconsistencies and distortions, particularly those in the tax treatment of housing. |

|

Infrastructure: Improve the selection of large-scale infrastructure projects |

|

|

No actions taken. |

□ Strengthen the influence of cost-benefit analysis in project selection and improve checks against cost inflation after projects are selected. |

Recent progress on structural reforms

Recent years have seen a welcome strengthening of the economic pillar of Norway’s socio-economic model. Much of the policy effort has concentrated on improving conditions for business, for instance the rate of corporate taxation has been reduced and there have been initiatives to address the shortfalls in labour force participation.