Improving business dynamism will be key to revive productivity growth and job creation in recovery. Reforms are hence needed to lower barriers to entry but also smooth the restructuring of firms and exit of non-viable ones. A more flexible labour market and activation policies will ensure the conditions for productive firms to grow and increase inclusiveness.

Economic Policy Reforms 2021

Belgium

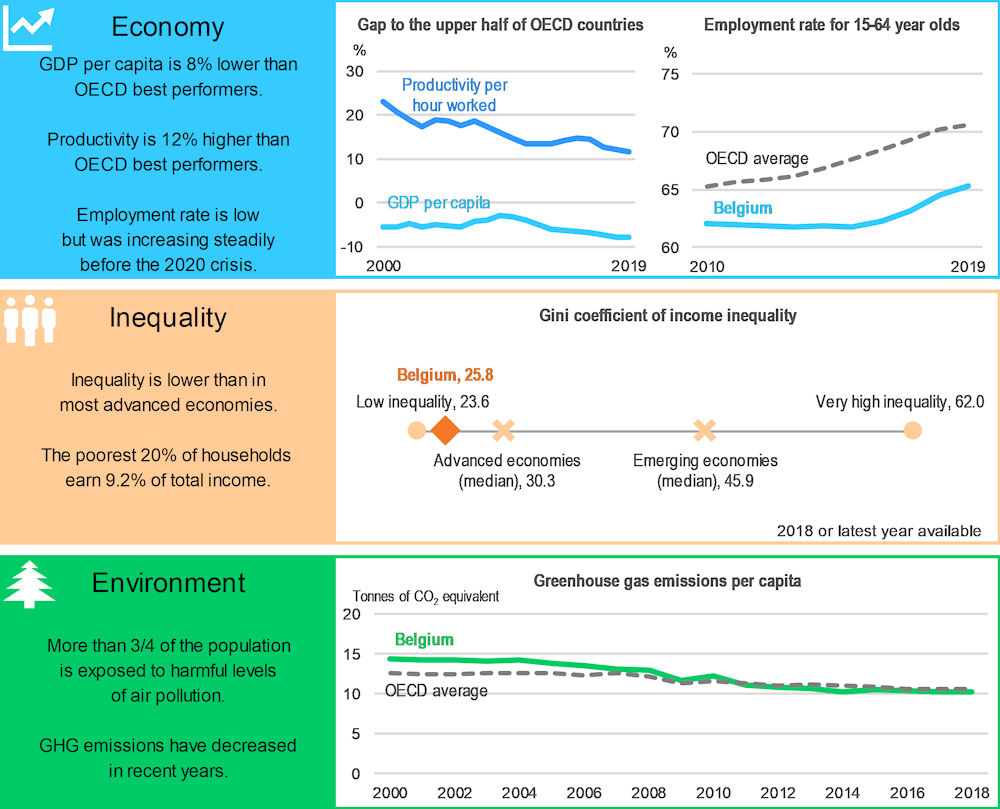

Belgium: Performance prior to the COVID-19 crisis

Economy: Percentage gap with respect to the population-weighted average of the highest 18 OECD countries in terms of GDP per capita (in constant 2015 PPPs).

Inequality: The Gini coefficient for disposable income measures the extent to which the distribution of disposable income among households deviates from perfect equal distribution. A value of zero represents perfect equality and a value of 100 extreme inequality.

Environment: Greenhouse gas (GHG) emissions include emissions or removals from land-use, land-use change and forestry (LULUCF). A high exposure to air pollution refers to above 10 μg/m3 of PM2.5.

Source: Economy: OECD, National Accounts, Productivity and Labour Force Statistics Databases; Inequality: OECD, Income Distribution Database and World Bank, World Development Indicators Database; Environment: OECD, Environment Database and United Nations Framework Convention on Climate Change (UNFCCC) Database.

Business dynamism is key for a stronger and more inclusive recovery

Firm entry is going to be crucial for job creation in the recovery. However, despite a number of recent reforms, the complex permit and licence system continues to create administrative burdens on start-ups, while stringent regulations remain in several professions, such as accountancy, legal and architecture services, in particular those relating to barriers to entry and licencing requirements. The stringency of product market regulation should be reduced further, notably by further simplifying administrative procedures and licence requirements to start a business or enter certain professional services, and lifting restrictions in retail, such as those on large outlets and shop opening hours.

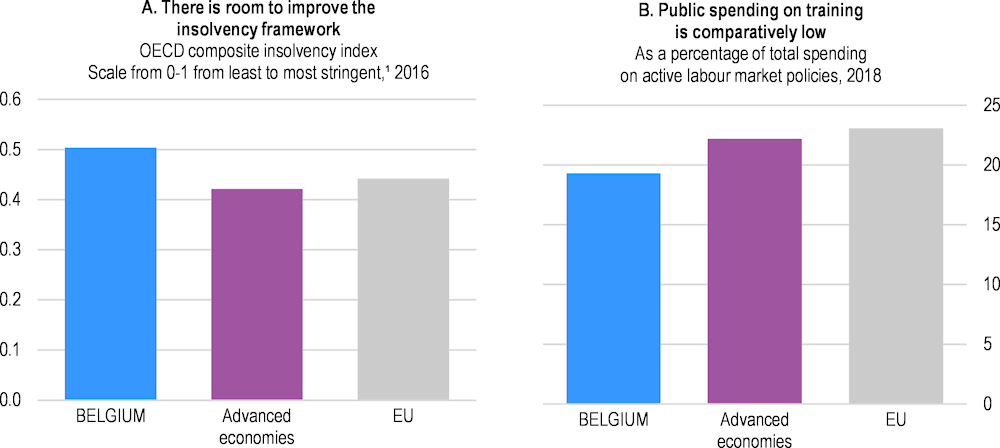

To deal with the legacy of the pandemic, the insolvency regime needs to ensure rapid, successful restructuring of viable firms while allowing for smooth exit of non-viable ones. While the insolvency moratorium introduced during the pandemic has saved distressed firms temporarily, the insolvency regime should be reformed further (Panel A) to allow for smoother reallocation of resources. In particular, creditors should be allowed to begin restructuring proceedings. As planned, simplified and pre-packaged special schemes should be adopted, which would help small businesses in particular as they usually lack necessary resources to deal with complex proceedings.

Impact of the pandemic on firms in hospitality and retail, in particular SMEs, risks compounding the low overall employment rates and particularly weak employment outcomes of those from disadvantaged socio-economic backgrounds. Up-skilling and re-skilling of workers will be increasingly relevant after the crisis. To this end, functioning of public employment services and training programmes should be enhanced, for instance by extending the use of tools for profiling of individualised risks across the country to identify jobseekers at a higher risk of becoming long-term unemployed. Funding allocated to training in activation policy should be increased, focusing on skills in high demand such as digital skills (Panel B). Such training programmes can be promoted by providing tax exemptions for jobseekers on their replacement income, as has been done in the recent “Jobs Deal” programme.

Belgium: Vulnerabilities and areas for reform

1. The 2018 update for Belgium is not an official update of the OECD indicator and has been calculated by the OECD Secretariat, based on the 2018 reform. This composite indicator aggregates 13 insolvency indicators across 4 dimensions: treatment of failed entrepreneurs, prevention and streamlining, restructuring tools and other factors. Calculations are based on the OECD questionnaire on insolvency regimes which collected specific information about personal and corporate insolvency regimes.

Source: Panel A: Adalet-McGowan, A. and D. Andrews (2018), "Design of Insolvency Regimes across Countries", OECD Economics Department Working Papers and OECD Economic Surveys: Belgium 2019; Panel B: OECD, Public expenditure and participant stocks on LMP.

A high degree of both wage centralisation across firms and wage coordination across sectors coupled with the rigidity of the indexation system makes it difficult to contain wages in line with productivity developments. Making the wage bargaining system more flexible, should enable firms to better align wages with their productivity growth, which can be achieved by, for instance, allowing firms to opt-out from collective agreements more easily. It would be particularly welcome in an uneven COVID-19 recovery across firms. Also, labour taxation should be decreased further. In particular, in the aftermath of COVID- 19, social security contributions for low wages workers should be further lowered to increase their employability. These tax wedge reductions should gradually decrease with increases in salaries to avoid a risk of low-wage trap.

Belgium: Summary of Going for Growth priorities and recommendations

|

2019-2020 Reforms |

Recommendations |

|---|---|

|

Competition and regulation: Streamline regulations that hamper business dynamism and productivity growth |

|

|

☑ Business code was revised and entered into force in 2019, substantially reducing the number of legal forms for companies and removing the minimal capital requirements for setting up private limited liability companies and cooperatives. ☑ Two professional bodies regulating and supervising accounting and tax advice services were merged in 2019, which can improve guidance for SMEs and reduce administrative formalities. ☑ In Flanders, the requirements for professional qualification were removed in some professions (such as professions in the construction sector). In Wallonia, the process to obtain buidling permits has been simplified and digitalised. |

□ Reduce barriers to entry and licencing requirements in various professions, such as in accountancy, legal and architecture services. □ Ease regulation of retail services, in particular the restrictions on large outlets, shop opening hours and the protection of incumbents. □ Further simplify administrative procedures and licence requirements to start a business. |

|

*Competition and regulation: Make the insolvency regime more conducive to reallocation of resources and productivity growth* |

|

|

*New priority * |

□ Reform the insolvency regime further, by including a timely initiation of restructuring by allowing creditors to begin insolvency proceedings. □ Introduce special insolvency procedures, as currently planned. □ Continue to digitise the judicial system to improve data collection and evaluation. |

|

*Labour market: Strengthen active labour market policies and training to reduce job-skill mismatch* |

|

|

*New priority * |

□ Extend the use of profiling tools to all public employment services across the country to develop tailor-made active labour market programmes for jobseekers. □ Increase spending on active labour market policies allocated to training. □ Following the adoption of a profiling tool in 2018 in Flanders and the ongoing development of a similar tool by the Walloon public employment services, extend the use of statistical profiling across the country to develop tailor-made ALMPs for jobseekers |

|

Labour market: Make wage setting more flexible |

|

|

No action taken. |

□ Allow for more decentralisation of wage bargaining, within the framework of sector-level agreements, to better align wages with productivity at the level of the individual firm. □ Consider allowing firms to opt-out from collective agreements more easily. |

|

Tax system: Reduce labour taxes to support employment |

|

|

☑ The 2015 reform to lower taxes on labour continued to be phased in over the past two years. |

□ Further lower social security contributions for low wages, financed by increases in less distortive taxes such as environmental taxes. □ Gradually phase-out the reduction in the tax wedge as earned income rises to reduce the risk of a low-wage trap. |

Recent progress on structural reforms

There has been limited progress, as the May 2019 election resulted in a caretaker government. A minority government was formed in March 2020 but lasted only until October last year, when the current government took office.