Improving activation and training policies is a top policy priority, as the pandemic especially affected sectors where many with weaker labour market attachment work. This can also help meet firms’ demand for skills. Reforming the tax and welfare system to remove high effective tax rates will boost participation and employment.

Economic Policy Reforms 2021

Ireland

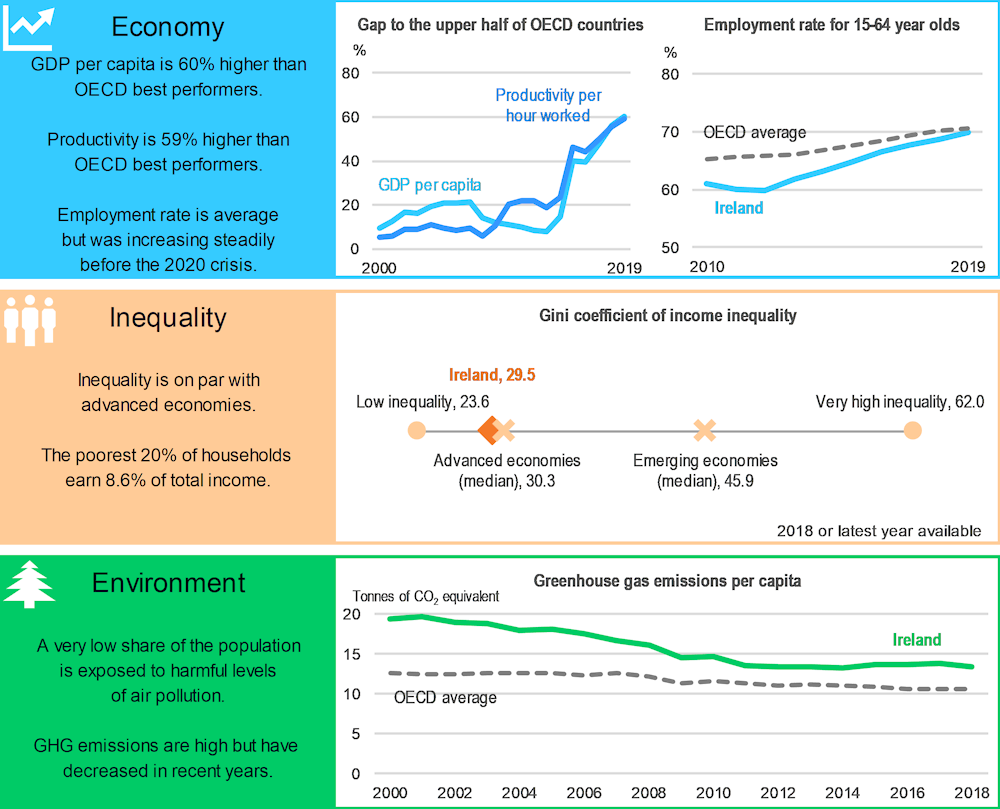

Ireland: Performance prior to the COVID-19 crisis

Economy: Percentage gap with respect to the population-weighted average of the highest 18 OECD countries in terms of GDP per capita (in constant 2015 PPPs). For Ireland GDP numbers are not corrected for net primary income payable to non-resident institutional units.

Inequality: The Gini coefficient for disposable income measures the extent to which the distribution of disposable income among households deviates from perfect equal distribution. A value of zero represents perfect equality and a value of 100 extreme inequality. The latest available data for Ireland is 2017.

Environment: Greenhouse gas (GHG) emissions include emissions or removals from land-use, land-use change and forestry (LULUCF). A high exposure to air pollution refers to above 10 μg/m3 of PM2.5.

Source: Economy: OECD, National Accounts, Productivity and Labour Force Statistics Databases; Inequality: OECD, Income Distribution Database and World Bank, World Development Indicators Database; Environment: OECD, Environment Database and United Nations Framework Convention on Climate Change (UNFCCC) Database.

Improving activation and training to boost employment and productivity

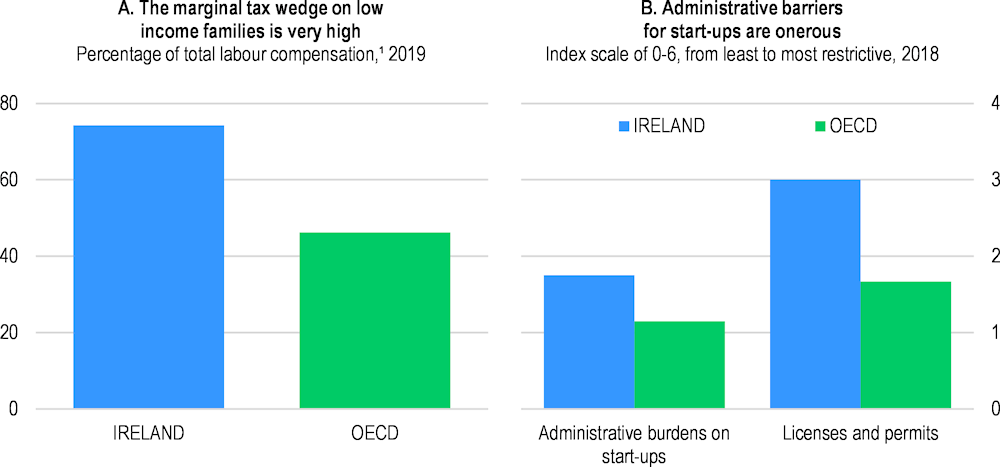

The tourism, hospitality and entertainment sectors are particularly affected by confinement measures. These are sectors where many of those with weaker attachment to the labour market are employed. If these workers fail to find jobs relatively quickly, the COVID-19 shock could leave a permanent scar. Ireland was already experiencing difficulties in raising labour force participation and employment of the young and those with lower levels of educational attainment prior to the pandemic. Therefore improving activation and training policies should be a top policy priority. This can also help meet firms’ demand for skills. Reforming the tax and welfare system to remove high effective tax rates will boost participation and employment of low-income households and could reduce the numbers remaining out of the labour force (Panel A).

Reallocation of workers to new high-growth industries and firms requires improved housing supply. This can be achieved - by reducing restrictions and relaxing demand support measures that only bid up housing prices. Replacing stamp duty with a broad-based land tax would provide better incentives for labour reallocation and efficient land use. Promoting strong economic poles outside Dublin would allow greater regional specialisation to emerge, supporting productivity.

The crisis exposed the two faces of the Irish economy. The relatively mild shock to GDP reflects the comparative strength of major multinational companies. The domestically-oriented part of the economy, with a history of weaker productivity growth, was less resilient. In comparison with many OECD countries, administrative barriers to start-ups are onerous, particularly with respect to licensing (Panel B). Reforming product market regulation would enhance competition and boost productivity of the domestic sector. Introducing one-stop-shops and enforcing “silence is consent” rules could reduce the costs of establishing a new business. There is also a scope to simplify regulation, as Ireland has some of the most complex regulatory procedures. Reducing compliance costs, as done already in e-communication, would again support firm formation and enhance competition.

Ireland: Vulnerabilities and areas for reform

1. Marginal tax wedge for a single person with two children, at 67% of average earnings. Labour taxes include personal income tax and employee plus employer social security contributions and any payroll tax less cash transfers.

Source: Panel A: OECD, Taxing Wages Database; Panel B: OECD, Product Market Regulation Database 2018.

Absence of universal primary healthcare contributes to poor disease management and congestion in hospitals. Moreover, high health spending, despite a relatively youthful population and recent spending increases, has not resulted in better measurable outputs. The Sláintecare Action Plan of 2019 aims to increase eligibility for universal primary healthcare on a phased basis. Budgeting in the health sector needs to improve, as access to primary healthcare is expanded, to prevent continued budget overruns.

To restart progress towards a carbon neutral economy, a gradual path for raising the carbon tax rate should be established and well communicated to households and businesses. Low-cost emission abatement in agriculture should be pursued. During the transition compensation for those negatively impacted, through retraining and supporting demand in the worst-affected areas, will be needed.

Ireland: Summary of Going for Growth priorities and recommendations

|

2019-2020 Reforms |

Recommendations |

|---|---|

|

Labour market: Improve labour force participation and employment |

|

|

☑ Springboard training courses, which are higher education free and subsidised courses leading to qualifications in areas where there are employment opportunities, have been adapted to reflect evolving business needs and opened to workers in small businesses. |

□ Enhance vocational education and job training for improving mobility and productivity. □ Reduce the high average effective tax rate faced by low-income households. □ Make all social benefits conditional on earnings, not employment status. |

|

Housing: Boost housing supply and reform support |

|

|

No action taken. |

□ Replace stamp duty with a broad-based land tax. □ Reduce restrictions and relax demand support measures, such as help to buy schemes that push up prices when supply is inelastic. □ Reduce the price of construction permits and registration of property charged by the relevant authorities. |

|

Competition and regulation: Ease barriers to entry and boost competition |

|

|

No action taken. |

□ Reduce the administrative burden to obtain permits and licensing for start-ups by fully developing the Integrated Licence Application Service, including achieving full take up. □ Establish “silence is consent” rule. □ Establish one-stop-shops for business creation. □ Simplify regulation towards good practices in the e-commerce sector. |

|

*Healthcare: Expand coverage and ensure cost containment* |

|

|

*New priority * |

□ Improve outturn compliance in health sector budgeting to prevent chronic budget overruns. □ Push through compensation reforms to health workers in the public sector. □ Continue the phased expansion of primary health care coverage. |

|

*Environmental policy: Use economic instruments to address climate change and local pollution* |

|

|

*New priority * |

□ Gradually raise the carbon tax rate according to a schedule that is well communicated to households and businesses. □ Continue to invest in public transport and consider further promoting digital-based ride sharing and the introduction of congestion charging. □ Remove subsidies on environmentally harmful goods, such as synthetic fertilisers. |

Recent progress on structural reforms

The authorities have faced the challenges of COVID-19 and Brexit, which have created enormous uncertainty including for policy. Nevertheless, needed reforms have been advancing. Work is ongoing to build on the Pathways to Work programme to help raise employment and participation. The Skills to Compete initiative has been designed to help retrain workers unable to re-enter employment due to COVID-19. Investment in social housing has been ramped up.