Improving conditions for businesses to thrive, compete and create quality jobs, while investing in skills of and opportunities for people should be high on the policy agenda. Economic hardship triggered by past macroeconomic crisis and by the pandemic has aggravated economic inequalities and highlighted the need for more effective social protection, including for vulnerable households whose livelihoods are outside the formal labour market.

Economic Policy Reforms 2021

Argentina

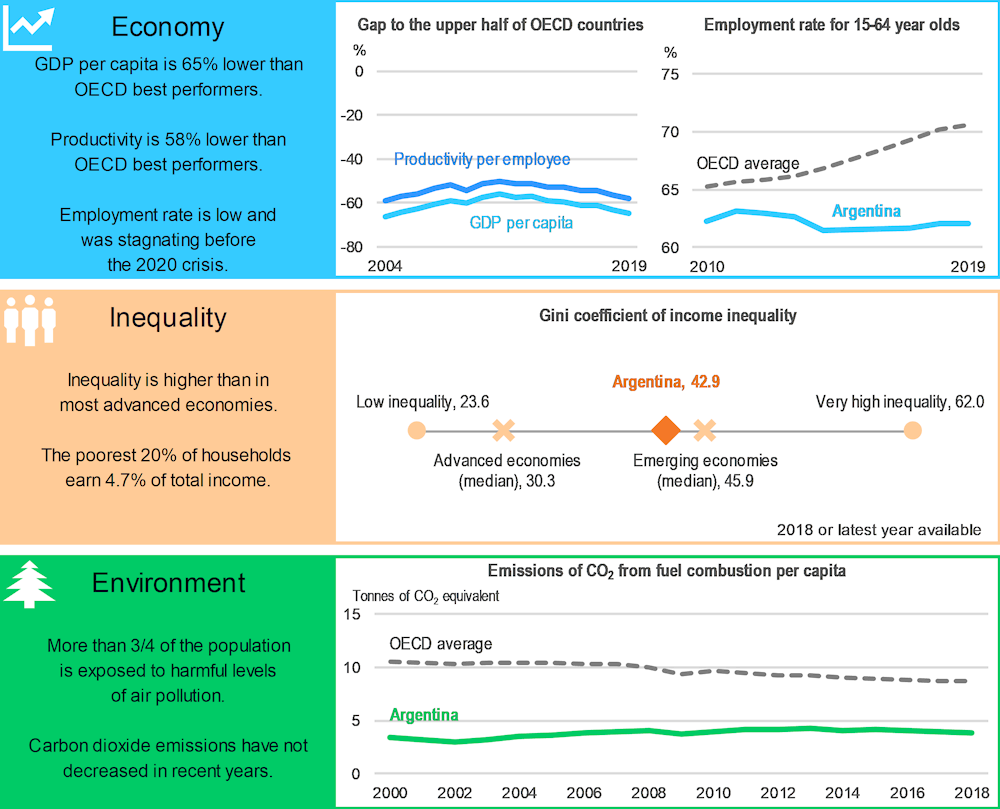

Argentina: Performance prior to the COVID-19 crisis

Economy: Percentage gap with respect to the population-weighted average of the highest 18 OECD countries in terms of GDP per capita (in constant 2015 PPPs).

Inequality: The Gini coefficient for disposable income measures the extent to which the distribution of disposable income among households deviates from perfect equal distribution. A value of zero represents perfect equality and a value of 100 extreme inequality. The latest available data for Argentina is 2019.

Environment: A high exposure to air pollution refers to above 10 μg/m3 of PM2.5.

Source: Economy: OECD, National Accounts, Productivity and Labour Force Statistics Databases. When not available International Labour Organisation for employment rate; Inequality: OECD, Income Distribution Database and World Bank, World Development Indicators Database; Environment: OECD, Environment and Energy Databases.

Reviving business dynamism and inclusiveness

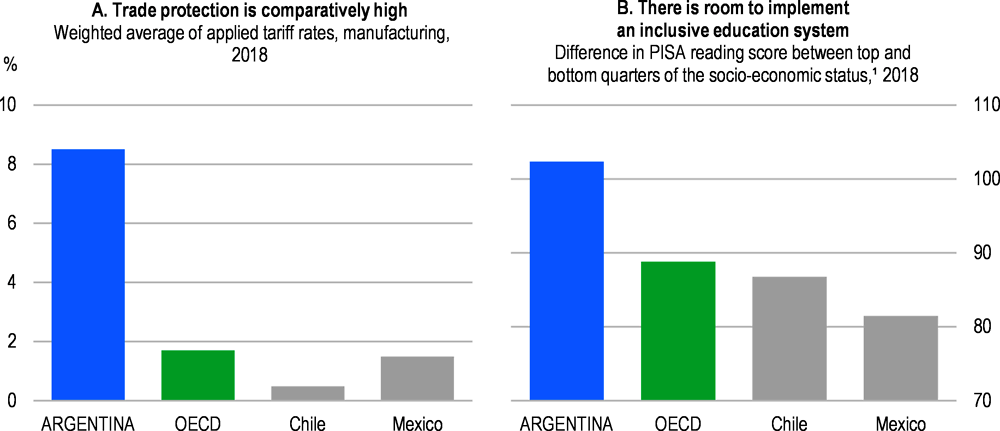

Argentina’s productivity performance has been weak over the last 20 years and the economy is significantly less integrated into the world economy than other emerging market economies. Reducing regulatory burdens would help the recovery by opening new opportunities for both people and businesses. Restrictive regulations curtail competition and raise the costs of many goods and services, while sustaining economic rents concentrated in the hands of few. Regulatory reforms that strengthen competition and foster reallocation could also allow more firms to export, which would create jobs that pay better and are more likely to be formal, while at the same time helping to address balance-of-payment challenges. Trade barriers remain high and lowering them would raise consumer purchasing power, especially for low-income households, and significantly reduce the cost of firms’ inputs (Panel A). Argentina has been so far on the side-lines of global value chains, implying significant lost opportunities for growth and well-being.

Providing better opportunities to all children and youths requires enhancing equity and outcomes in education. This could help boost productivity and reduce income inequality at the same time. Educational outcomes remain far below OECD standards, and are strongly linked to students’ socio-economic status (Panel B). To this end, investing more in early childhood education to reduce the cognitive development gaps attributable to heterogeneous family environments early in life and reducing early drop-out rates is needed. The quality of teaching could also be improved by reshaping teacher training and supporting their professional growth early on. Scaling up vocational and technical training, for instance by strengthening active labour market policies, would help workers reap new opportunities that require different skill sets.

To improve the resilience of the economy, these reforms should be complemented by stronger efforts to reduce high labour informality and strengthen social protection for all workers. Social protection could be strengthened by building on existing cash transfer schemes, which include informal workers, while simultaneously reducing the cost of creating formal jobs, for example by reducing social security contributions for low-income workers. Once the recovery sets hold, there is significant scope to improve the efficiency of the tax system, including by broadening tax bases and moving towards less distortive taxes.

Argentina: Vulnerabilities and areas for reform

1. A student’s socio-economic status is estimated by the PISA index of economic, social and cultural status (ESCS), which is derived from several variables related to students’ family background: parents’ education, parents’ occupations, a number of home possessions that can be taken as proxies for material wealth, and the number of books and other educational resources available in the home.

Source: Panel A: World Bank, World Integrated Trade Solution Database; Panel B: OECD, PISA Database.

Argentina: Summary of Going for Growth priorities and recommendations

|

2019-2020 Reforms |

Recommendations |

|---|---|

|

Competition and regulation: Reduce barriers to trade and regulatory burdens |

|

|

☑ A trade agreement has been signed with the European Union in 2019, but not yet implemented. It can provide a significant boost to competition and productivity. |

□ Reduce tariff and non-tariff barriers to international trade, starting with capital goods and intermediate inputs. □ Reduce domestic regulatory barriers to entrepreneurship and market entry, including at the level of provincial and local governments. |

|

Education and skills: Enhance outcomes and equity in education |

|

|

No actions taken. |

□ Keep expanding early childhood education. □ Merge smaller teacher training institutions to exploit scale economies and strengthen their governance. |

|

Labour market: Strengthen active labour market programmes, with a focus on women and on training |

|

|

No actions taken. |

□ Bolster adult training programmes and vocational education and training, with a special focus on women. |

|

*Social Protection: Reduce labour informality and strengthen social protection for all workers* |

|

|

*New priority * |

□ Strengthen income support for dismissed workers by building on existing cash transfer schemes, which include informal and self-employed workers. □ Extend the unemployment insurance scheme with individual accounts currently used in the construction sector to other sectors of the economy, to allow a medium-term transition towards lower severance costs and stronger formal job creation. |

|

Tax system: Improve the efficiency of the tax system |

|

|

No actions taken. |

□ Phase out the provincial turnover tax and financial transaction tax. □ Broaden the VAT base by reducing exemptions and special rates. □ Lower the basic deduction in personal income taxes while making rates more progressive. □ Lower social security contributions for low-income workers to strengthen formal job creation. □ Remove the personal income tax exemption of civil servants in the judiciary branch entirely. |

Recent progress on structural reforms

A severe macroeconomic crisis, compounded by the COVID-19 pandemic, has attracted much of the political attention away from solving structural challenges.