The COVID-19 crisis has brought to the fore the vulnerability of the population to economic shocks, notably due to extensive informality, lagging skills and low social security coverage. Reforms in areas of skills, labour market regulation and barriers to entrepreneurship are hence top priorities for a more resilient and equitable growth.

Economic Policy Reforms 2021

Indonesia

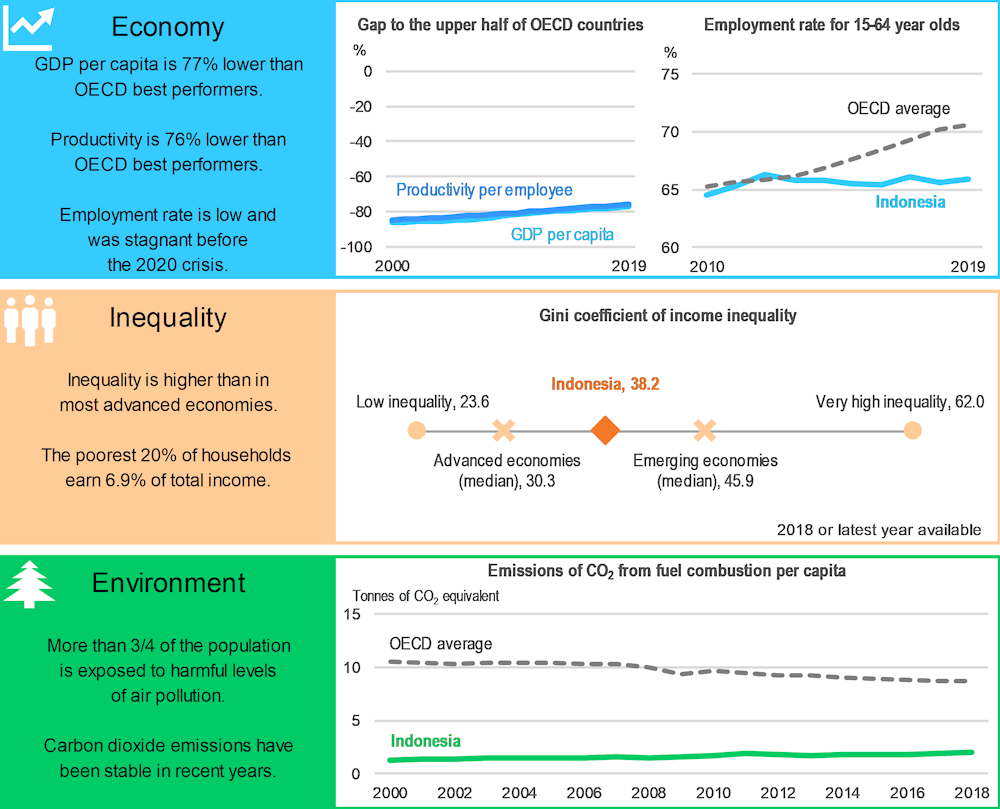

Indonesia: Performance prior to the COVID-19 crisis

Economy: Percentage gap with respect to the population-weighted average of the highest 18 OECD countries in terms of GDP per capita (in constant 2015 PPPs).

Inequality: The Gini coefficient for disposable income measures the extent to which the distribution of disposable income among households deviates from perfect equal distribution. A value of zero represents perfect equality and a value of 100 extreme inequality. The latest available data for Indonesia is 2019.

Environment: A high exposure to air pollution refers to above 10 μg/m3 of PM2.5.

Source: Economy: OECD, National Accounts, Productivity and Labour Force Statistics Databases; Inequality: OECD, Income Distribution Database and World Bank, World Development Indicators Database; Environment: OECD, Environment and Energy Databases.

Tackling informality is crucial for the recovery and medium-term growth

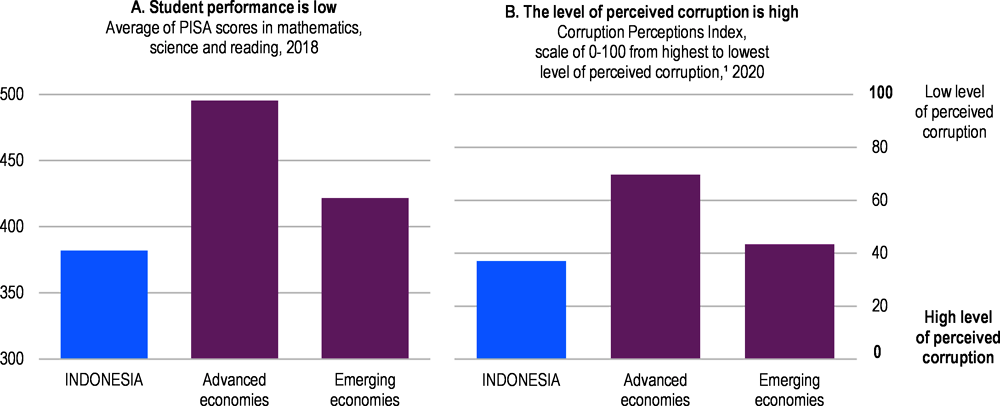

Improving outcomes in education is key as the economy becomes more digitalised. Sizeable progress has been achieved in education attainment in the past 20 years. Almost all children attend primary education now and enrolment in secondary and tertiary education is continuously increasing. However, many pupils leave school at 15 without basic skills, pointing to low quality of teaching (Panel A). In this respect reforms need to improve teacher evaluation and increase the availability of and incentives for teachers to take up training. Vocational education should have larger involvement of the private sector to ensure skills relevant for the job market while the enrolment of students from disadvantaged backgrounds could be incentivised through targeted cash transfers.

Education reforms need to go hand in hand with reforms of labour market regulations to reduce informality, which is particularly high. Minimum wages are high relative to average incomes and severance pay provisions are generous, even though compliance with these requirements is low. Building on recent reforms, greater flexibility in the labour market coupled with appropriate worker protection would lead to job creation in the formal sector, productivity enhancement and well-being of the population. In particular, pilot lowering of employment protection and minimum wages for youth in special economic zones should be rolled out, and if successful, extended more broadly. In parallel, the statutory minimum wages in each province should be better aligned with local characteristics.

An additional boost to formal job creation would come from continued easing of barriers to entrepreneurship and investment. Key barriers to address include those at the sub-national level, for self-employed and small businesses and restrictions on foreign direct investment (FDI), in particular by eliminating discriminatory requirements against foreign investors. The economy would also benefit from strengthening institutions to fight corruption (Panel B). The Corruption Eradication Commission (KPK) is well respected and needs to remain independent, which is particularly important in the context of COVID-19, with massive discretionary public spending.

Indonesia: Vulnerabilities and areas for reform

1. The Corruption Perceptions Index aggregates data from different sources that provide perceptions of business people and country experts of the level of corruption in the public sector.

Source: Panel A: OECD, PISA Database; Panel B: Transparency International Database on Corruption Perceptions.

To free up funds for education and crucial infrastructure investment, as well as for targeted and effective social programmes, reforms of energy subsidies should aim to reduce their share in government expenditure.

Indonesia: Summary of Going for Growth priorities and recommendations

|

2019-2020 Reforms |

Recommendations |

|---|---|

|

Education and skills: Improve outcomes in education |

|

|

☑ A 2020 teacher certification scheme (Pendidikan Profesi Guru) aims to improve the linkages between teacher allowance and student results. It also includes one year of training (six months) for new (current) teachers. |

□ Introduce regular teacher assessment and link teacher remuneration more closely to performance and ongoing training. □ Further increase enrolment rates through cash transfers for eligible students. □ Increase employers’ engagement in vocational education. |

|

Labour market: Reform labour regulations to reduce informality |

|

|

☑ The November 2020 Omnibus Law on Job Creation includes lower severance payments, an unemployment fund and exemptions from the minimum wage. |

□ Pilot lower levels of employment protection and discounted minimum wages for youth in special economic zones. This includes lowering severance pay, accompanied by the creation of individual unemployment insurance accounts. If these trials are successful, extend them. □ Reduce administrative burdens for self-employed workers and micro enterprises to encourage formalisation. |

|

Competition and regulation: Ease barriers to entrepreneurship and investment, and strengthen institutions to fight corruption |

|

|

☑ One year after its launch, in 2019, the online single submission (OSS) system was upgraded to include more specifications and be easier to use. ☑ The 2020 Omnibus Law on Job Creation simplifies processes to obtain licences and permits. ☑ The Omnibus Law replaces the negative investment list with a new and much shorter list of six sectors precluded to foreign investors. ☑ In 2019, an external supervisory board was introduced weakening the independence of the Corruption Eradication Commission. |

□ Collect user feedback to improve the online single submission (OSS) system. □ Continue to streamline and simplify business regulation, paying special attention to regulations in sub-national jurisdictions. □ Prioritise further liberalisation of FDI in services sectors and eliminate discriminatory requirements against foreign investors in horizontal regulations (such as different minimum capital requirement and preferential treatment to domestic companies in public procurement). □ Sustain the fight against corruption, including by increasing resources to the Corruption Eradication Commission and respecting its independence. |

|

Infrastructure: Improve the regulatory environment for infrastructure |

|

|

☑ From 2019, fiscal transfers to sub-national governments earmarked for infrastructure depend on local government’s proposals. |

□ To increase private sector involvement, legal and regulatory certainty should be increased, including through clearer property rights and project documentation for public-private partnerships. □ Increasing the transparency of state-owned enterprises could help ensure that they do not crowd out private investment. □ Sub-national governments should be encouraged to allocate more of their budget to infrastructure spending. |

|

Energy: Continue to make energy prices more cost-reflective |

|

|

No action taken. |

□ Continue to shift away from subsidies and towards more targeted social assistance to address distributional concerns. □ Allow fuel prices to move more with prices in international markets. □ Review the 2017 regulations determining tariffs for independent power producers with the aim of making prices more cost-reflective and increasing certainty for investors. |

Recent progress on structural reforms

The 2020 Omnibus law aims to simplify the regulatory framework and can be a milestone for boosting growth. Appropriate implementation will therefore be important to this end. Lifting restrictions on business operations can attract investors and create jobs, especially in the context of the Regional Comprehensive Economic Partnership (RCEP) agreement signed in 2020.