The level of per capita health spending, which captures both individual and population healthcare needs, and how this level changes over time depends on a wide range of demographic, social and economic factors, as well as the financing and organisational arrangements of a country’s health system.

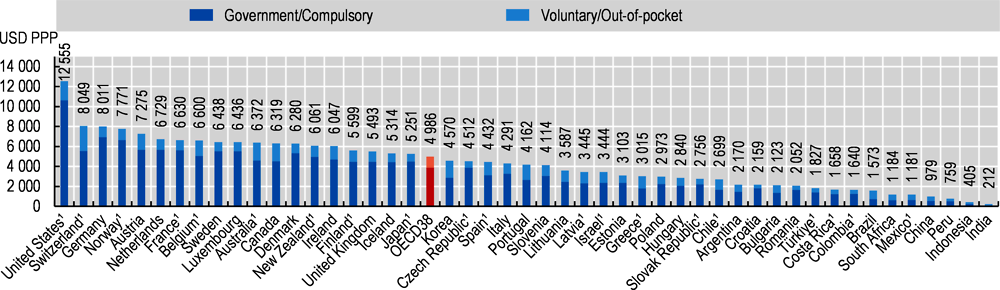

In 2022, average per capita health spending in OECD countries (when adjusted for differences in purchasing power) was estimated to have reached nearly USD 5 000. In the United States, it reached the equivalent of USD 12 555 for every US citizen. Switzerland and Germany were the next highest spenders in the OECD, but at around USD 8 000 this was still less than two‑thirds of the level in the United States (Figure 7.4). After Norway and Austria, a further group of western European countries, as well as Australia, Canada and New Zealand all spent between USD 6‑7000. Per capita health spending broadly decreased across Southern European countries, Central and Eastern European countries to the Latin American OECD member countries, with spending in Mexico (USD 1 181) at around a quarter of the OECD average.

Figure 7.4 also shows the split of health spending based on the type of healthcare coverage, either organised through government health schemes or compulsory insurance (public or private), or through voluntary arrangements such as private voluntary health insurance or direct payments by households (see also indicator “Health expenditure by financing schemes”). On average across OECD countries, about three‑quarters of all health spending is financed through government or compulsory insurance schemes.

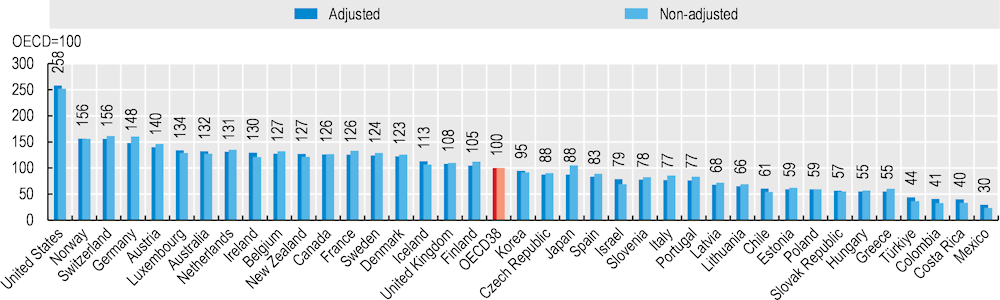

The risk of illness and ill-health generally increases with age. A population with an older demographic structure can expect higher mortality rates, greater incidence and prevalence of certain diseases, and thus higher demands for healthcare and, by consequence, higher spending on health. Using a standard age‑spending profile, the impact of different population structures on overall health spending across OECD countries can be assessed using indirect standardisation (OECD, forthcoming[1]). Figure 7.5 indicates that countries such as Israel and Ireland, and some of the Latin American OECD member countries could expect higher health spending relative to the OECD average if a standard population structure was applied, whereas those countries with older populations (e.g. Japan, Germany and Italy) could expect lower spending.

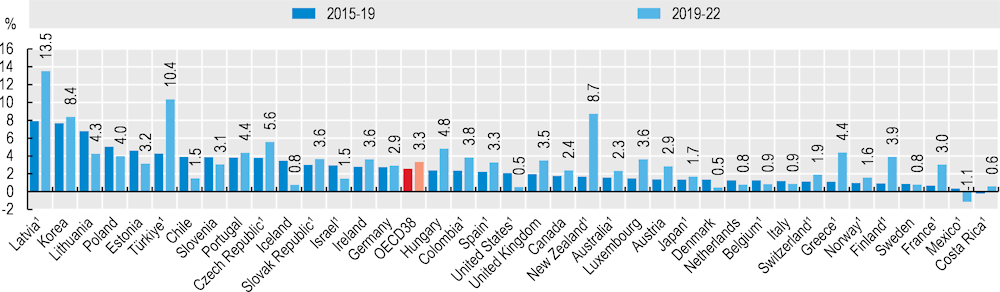

In the years leading up to the COVID‑19 pandemic, annual average per capita spending on healthcare grew by an average of 2.6% across OECD countries (Figure 7.6). In Latvia, Lithuania as well as Korea, annual spending growth between 2015 and 2019 was between 6 and 8%, while in most Nordic countries and France, growth was much more moderate at less than 1% on average. The emergence of COVID‑19 in 2020 led to sharp increases in health spending, particularly from governments as they mobilised funds to slowdown and tackle the effects of the pandemic. Between 2019 and 2022, average per capita spending growth in the OECD accelerated to 3.3% per year, with a peak reached in 2021 before contracting in the most recent year (Figure 7.2).

However, diverging trends in the pattern of health spending growth across countries during the pandemic could be observed due to the severity of the various waves across different regions, the extent and duration of containment policies, but the variation in how healthcare is financed in countries can also play a role. Of the 38 OECD countries, around two‑thirds saw higher growth during the pandemic than in the years immediately preceding the crisis, and only Mexico is expected to have seen overall negative growth during the most recent three‑year period. Some countries – Latvia and Türkiye, have seen double‑digit growth in health spending between 2019 and 2022, reflecting both the severity and the continuation of the pandemic’s effects into 2022. In the Asia-Pacific region, Korea and New Zealand, have both seen growth of more than 8% on average between 2019 and 2022. Both countries had strong containment policies in place during 2020 and 2021, with a loosening resulting in some upsurge in COVID‑19 cases in 2022.