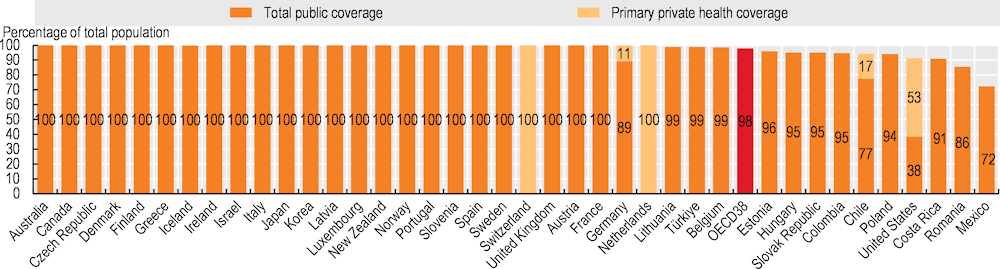

The share of a population covered for a core set of health services offers an initial measure of access to care and financial protection. Most OECD countries have achieved universal or near-universal coverage for a core set of health services, which usually include consultations with doctors, tests and examinations, and hospital care (Figure 5.1). National health systems or social health insurance have typically been the financing schemes for achieving universal health coverage. A few countries (such as the Netherlands and Switzerland) have achieved universality through compulsory private health insurance – supported by public subsidies and strong regulation on the scope and depth of coverage.

Population coverage for core services remained below 95% in six OECD countries in 2021, and below 90% in Mexico and the United States. Coverage was also below 90% in Romania. Mexico has expanded coverage since 2004, when it was around 50%, but coverage has fallen in recent years. In the United States, the share of uninsured people decreased following the Affordable Care Act, from about 13% in 2013 to 9% in 2015, with a more gradual reduction in uninsured people since then (United States Census Bureau, 2022[1]). Uninsured people tend to be working-age adults with lower education or income levels. In Ireland, although coverage is universal, fewer than half of the population are covered for the cost of all general practitioner (GP) services, but new eligibility measures introduced in 2023 will increase the proportion covered for GP services.

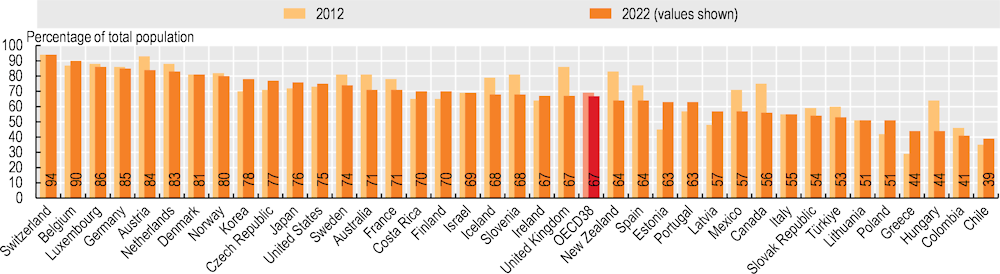

Beyond population coverage rates, satisfaction with the availability of quality health services offers further insight into effective coverage. The Gallup World Poll collects data on citizens’ satisfaction with health and other public services. While contextual and cultural factors influence survey responses, the poll allows citizens’ opinions to be compared based on the same survey question. Satisfaction with the availability of quality health services averaged 67% across OECD countries in 2022 (Figure 5.2). Swiss and Belgian citizens were most likely to be satisfied (90% or more), while those in Chile, Colombia, Hungary and Greece were least likely to be satisfied (fewer than 50%). While satisfaction levels have decreased slightly on average across OECD countries over the past decade, this masks wide cross-country variation: Hungary, Canada, New Zealand and the United Kingdom all experienced large declines in satisfaction (a drop of around 20 percentage points), whereas in Estonia and Greece satisfaction levels increased by 15 percentage points or more.

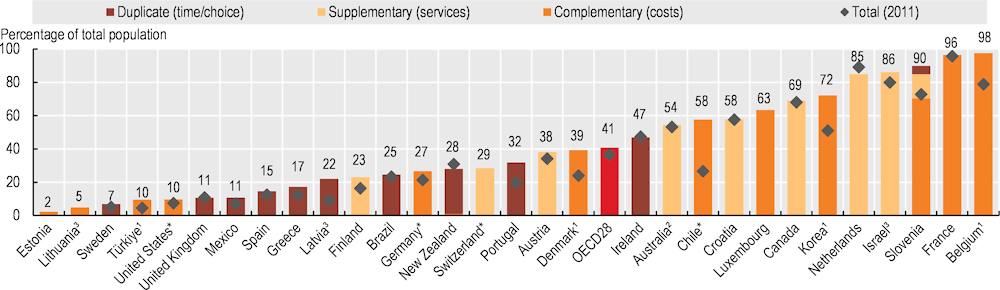

In many countries, citizens can purchase additional health coverage through voluntary private health insurance. This can cover any cost-sharing left after basic coverage (complementary insurance), add further services (supplementary insurance), or provide faster access or a wider choice of providers (duplicate insurance). Among 28 OECD countries with recent comparable data, 11 had additional private insurance coverage for over half of the population in 2021 (Figure 5.3). Complementary insurance to cover cost-sharing is widely used in Belgium, France and Slovenia (over 90% of the population). Israel and the Netherlands had the largest supplementary health insurance market (over 80% of the population). Duplicate private health insurance was most widely used in Ireland and Australia. In the United States, around 10% of the population had complementary private health insurance. This is in addition to the 53% of the American population who had primary private health insurance. Over the last decade, the population covered by additional private health insurance has increased in 20 of 24 OECD countries with comparable data. Several factors determine how additional private health insurance evolves – notably the extent of gaps in access to publicly financed services and government interventions directed at private health insurance markets.