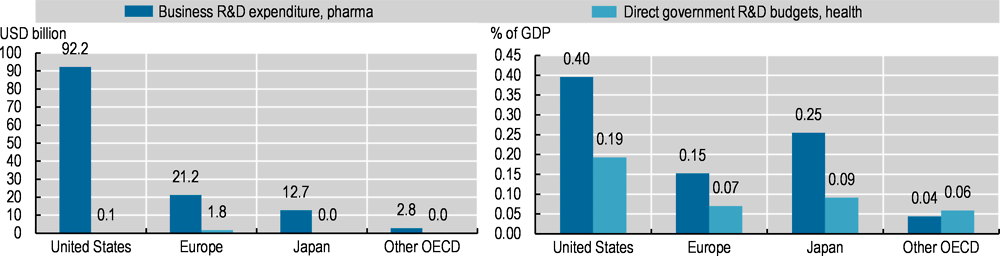

Pharmaceutical research and development (R&D) is funded via a mix of private and public sources. Governments typically fund basic and early-stage research through budget allocations, research grants and public ownership of research and higher education institutions. The pharmaceutical industry funds R&D across all phases and most pre‑registration clinical trials, but mostly contributes to translating and applying knowledge to develop products, with some support from R&D subsidies or tax credits. In 2021, governments in 35 OECD countries for which data are available, collectively budgeted USD 69 billion for health-related R&D. While this figure goes beyond pharmaceuticals, it understates total government support, as it excludes most tax incentives and funding for higher education and publicly owned enterprises. About two‑thirds of this was spent in the United States (USD 45 billion), which also spent the most as a share of gross domestic product (GDP) (Figure 9.9). Since 2010, government-allocated budgets for health-related R&D have increased by 45%.

The pharmaceutical industry spent USD 129 billion on R&D in 2021, with the majority again spent in the United States. Business-based pharmaceutical R&D expenditure (BERD) has increased by 39% in real terms since 2010. Most of this growth occurs in OECD countries, specifically driven by the United States (69% of the OECD total). However, the non-OECD share is increasing. Notably, R&D expenditure in partner country the People’s Republic of China increased from USD 4.9 billion (in constant 2015 PPPs) to USD 14.2 billion in 2019 (189%) – a higher growth rate than any OECD country (OECD, 2021[1]).

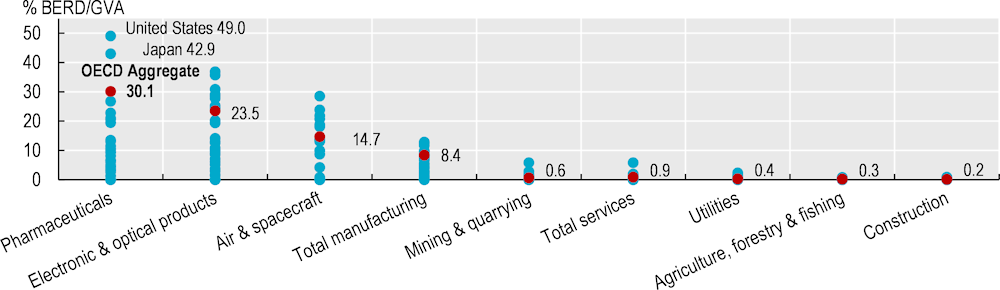

The pharmaceutical industry is more R&D intensive than other, similar industries. Among OECD countries, it spends over 30% of its gross value added on R&D – more than the electronics and optical industry (23.5%), air and spacecraft industry (14.7%) and manufacturing as a whole (8.4%) (Figure 9.10). This is a notable increase, as R&D intensity of the pharmaceutical industry was only 13.3% in 2018: below that of the electronics and optical industry (16%) and near the air and spacecraft industry (13.1%).

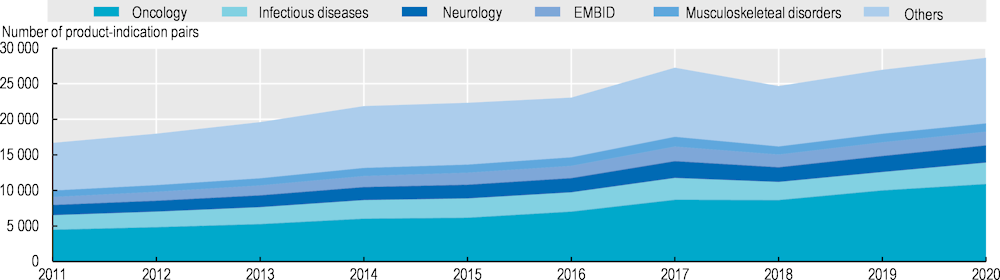

Actual R&D activity can be observed through the number of products or medicines in development by therapeutic class and indication of treatment. Between 2011 and 2020, the total number of product-indication combinations that were in active development worldwide nearly doubled, to reach 28 643 (Figure 9.11), although this was driven in part by products with multiple indications. In any given year, the majority of active development projects are pre‑existing projects that remain in active development. However, the number of new projects that enter active pre‑clinical or clinical development has also increased – from 2077 in 2012 to 8 227 in 2020. In terms of disease focus, product development priorities have not changed dramatically since 2011. Cancer has accounted for the largest share of product indications in development in every year since 2011, and has increased steadily – from 27% of all product-indication pairs in 2011 to 38% in 2020.