While human resources are essential to the health and long-term care sector, physical resources are also a key factor in the production of health services. How much a country invests in new health facilities, diagnostic and therapeutic equipment, and information and communications technology (ICT) can have an important impact on the capacity of a health system to meet the healthcare needs of the population. The COVID‑19 crisis has shone a spotlight on some of the infrastructure challenges. Health systems, and hospitals in particular, were placed under immense strain. Some countries lacked the necessary physical resources to respond to the sudden influx of seriously ill COVID‑19 patients. Having sufficient equipment in intensive care units and other health settings helps to avoid potentially catastrophic delays in diagnosing and treating patients. Non-medical equipment is also important, notably the IT infrastructure needed to better monitor population health, both in acute situations and in the long term. Investing in capital equipment is therefore a prerequisite to strengthening overall health system resilience.

Capital investment fluctuates from year to year, as investment decisions can be more dependent on economic circumstances and political or business choices as well as reflecting future needs and past levels of investment. As with any industry, a lack of investment spending can lead to an accumulation of problems and bigger costs in the future as current equipment and facilities deteriorate.

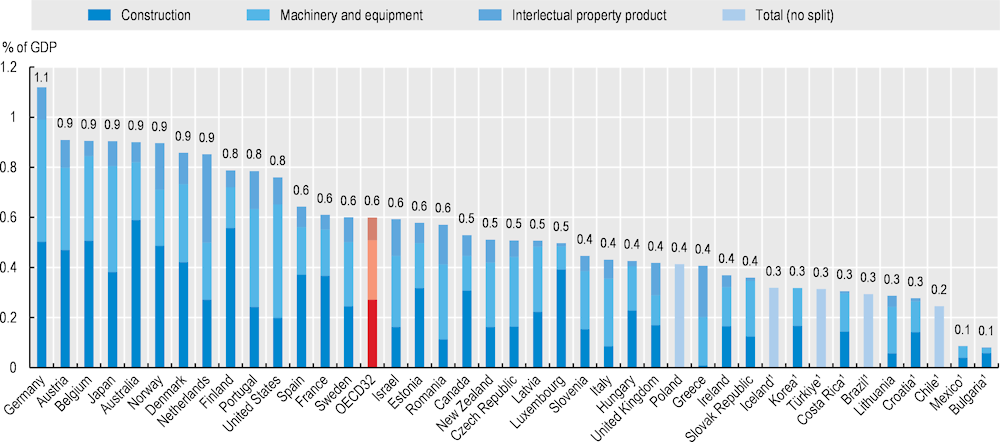

In the five years between 2017 and 2021, average annual capital expenditure in the health sector in OECD countries was just below 0.6% of GDP. This compares to an average of around 9% of GDP on current health spending over the same period (see indicator “Health expenditure as a share of GDP”) (Figure 7.21). Germany was the highest annual spender, consistently allocating around 1.1% of its GDP each year on new construction projects, medical and non-medical equipment, and technology in the health and social sector. Austria, Belgium, Japan, Australia and Norway were the next highest group of capital spenders at around 0.9% of GDP, although spending was more variable over that period in the case of Australia. Of the other G7 countries, the United States was a relatively high spender at around 0.8% of GDP per year, while France invested around 0.6% of its GDP per year. Both Italy and the United Kingdom remained below the average at just over 0.4% of GDP.

Capital spending covers a broad range of investments from construction projects (that is, hospitals and healthcare facilities), equipment (e.g. medical and ICT equipment) to intellectual property (including databases and software). Figure 7.21 shows that, on average in OECD countries, 45% of capital expenditure went towards construction projects, 40% on equipment, and the remaining 15% on intellectual property. Finland and Portugal both had a similar level of overall investment, but whereas Finland allocated around 70% on the construction of health and social care facilities, Portugal invested the same proportion on equipment and on digital solutions and data, combined.

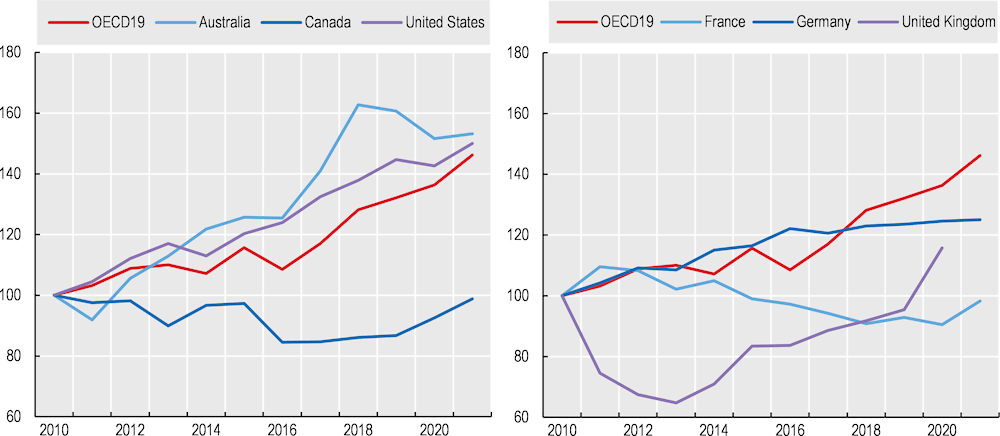

Figure 7.22 shows an index of capital spending in real terms since 2010 for the OECD and a selection of OECD countries. On average across the OECD, annual investment was more than 40% higher (in real terms) in 2021 compared with the levels of investment reported in 2010. Australia and the United States have closely followed the overall OECD trend and increased their annual capital spending over that period by around 50%. On the other hand, Canada invested at around the same level in 2021 compared with 2010. In Europe (right panel), Germany has seen a steady increase in capital investment over the last ten years or so, even if the growth has been below that of the OECD as a whole. Both France and the United Kingdom saw investment levels drop in the 2010s, but these have recovered in the last few years.